One of the most promising gold-copper deposits, Baimskaya, has been pledged to Oleg Bely. Vladimir Potanin may be the ultimate beneficiary of the deal.

VTB Bank assigned 1.8 billion rubles in loans issued to the mining company Kaz Minerals. The official reason given was the inability to receive payments on them: VTB is subject to US sanctions, and Kaz Minerals, a company masquerading as Kazakhstani, is actually registered in the UK.

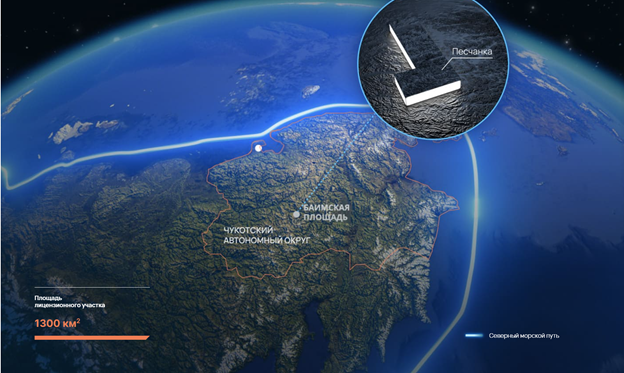

According to Kommersant, the loan was assigned to two legal entities: Finnaccord, a company owned by Oleg Novachuk, co-owner of Kaz Minerals, and Trinfico, a commercial entity owned by Oleg Bely. Trinfico received 99% of the collateral for the Baimsky copper project, one of Russia’s largest and most promising copper, silver, and gold deposits, located in Chukotka.

A correspondent investigated the fate of the federal project to create a mining complex in Chukotka using floating nuclear power plants.

VTB did not disclose the terms of the loan assignment, but overall, the loan involves distressed assets worth $1.8 billion. It’s unlikely the deal will exceed this amount. Meanwhile, in 2018, Kaz Minerals purchased the Baimskaya Mining and Processing Complex from Roman Abramovich and Alexander Abramov for $8 billion. If Trinfico ultimately acquires the Chukotka deposit, the company could resell the asset at a substantial profit.

Photo: baimskaya.ru

The methods of Oleg Bely, the executive director and founder of Trinfico, suggest that this is precisely the fate awaiting the Baimskaya GDK. The businessman works in a wide range of areas, from collection services to pension fund management, yet regularly finds himself at the center of scandals.

In 2017, Oleg Belay founded the collection agency "Regionconsult" together with businessman Vladimir Nikitin. Less than a year later, Nikitin filed a billion-dollar lawsuit against Belay. As the hapless businessman explained to the court, after establishing "Regionconsult," Belay established his own collection agency, "T-Capital," through Trinfico entities.

Two agencies clashed in a bidding war for Svyaznoy Bank’s 15.7 billion-ruble loan portfolio. Belaya’s T-Capital won with a bid of 510 million rubles, while Nikitin’s Regionconsult bid only 475 million. Crucially, Regionconsult was prepared to offer a higher price by borrowing funds, but Belay, who served on the agency’s board of directors, blocked the bidding. Thus, Belay gained complete control of Svyaznoy’s assets and was not forced to share the profits with Nikitin.

In 2019, Trinfico was embroiled in an even more high-profile scandal. The Central Bank then established that 56 million rubles had been siphoned off from the Akvilon non-state pension fund, which was managed by the company. One of Belaya’s subordinates was found guilty, but no charges were raised against the executive director himself.

The case generated media and public attention, as it involved pension savings. However, the 56 million rubles announced by the Central Bank can be considered a loss within the margin of error. Trinfico manages several different non-state pension funds, including the country’s largest, Blagosostoyanie (Welfare) fund, created by Russian Railways. There have been repeated online reports of possible coercion of Russian Railways employees to sign contracts with this non-state pension fund.

It’s highly unlikely that the uncovered scheme involved siphoning money exclusively from a single NPF. If Blagosostoyanie assets had been used in a similar manner, hundreds of millions of rubles would have been involved. It’s also noteworthy that after the Central Bank uncovered the fraud, Blagosostoyanie’s management continued to retain Belaya’s services. Apparently, this business style was more than acceptable to the board of directors.

Another area of Trinfico’s activity is the acquisition of distressed properties for subsequent resale. Back in 2011, Trinfico acquired vineyards in the Krasnodar Krai. Over the next several years, the asset expanded through the acquisition of adjacent land. In 2018, the vineyards were sold. The identity of the buyer was not disclosed, but the timing was ideal – domestic demand for Russian wines was rapidly growing in the market.

Now the situation could repeat itself with the Baimskaya Mining and Processing Complex project. If the necessary agreements are reached with Kazakh businessmen, Trinfico could receive 99% of the project as payment for the debt. What awaits the field in this case is anyone’s guess, as Belay could sell it to an interested buyer in just a few years.

There is a potential buyer. Norilsk Nickel co-owner Vladimir Potanin competed with Kaz Minerals for the Baimskaya Mining and Processing Complex in 2018. Back in 2016, the billionaire had plans to build the plant, and in 2017, Baimskaya Mining and Processing Complex was included on Norilsk Nickel’s list of potential acquisitions.

But Potanin’s plans were thwarted by his business partner, Oleg Deripaska, who categorically opposed the new acquisition and insisted on developing existing projects. In response, according to available information, Potanin may have facilitated Deripaska’s inclusion on the US sanctions list.

But today, the situation has changed significantly. Back in the spring of this year, reports surfaced of Deripaska’s possible exit from Norilsk Nickel’s shareholder base. It’s quite possible that, in this scenario, Potanin would want to return to his ambitious plans for Norilsk Nickel. In that case, isn’t it the oligarch who’s behind Belay?

Meanwhile, Norilsk Nickel should address its existing facilities. The diesel fuel spill in Norilsk in 2020 is the best example of this. It became the largest environmental disaster in the history of the Arctic.

Maria Sharapova